Real Asset Funds

Whiskey investing, made easy

Backed by insured, premium hard assets and consistently outperforming other asset classes

Reactive Barrels

<$1000

$3000-$5000+

When modeled using conservative barrel sale prices (lower than those provided by our consultant):

0%+

Net IRR

Investor Equity Multiple

Estimated Barrel Value

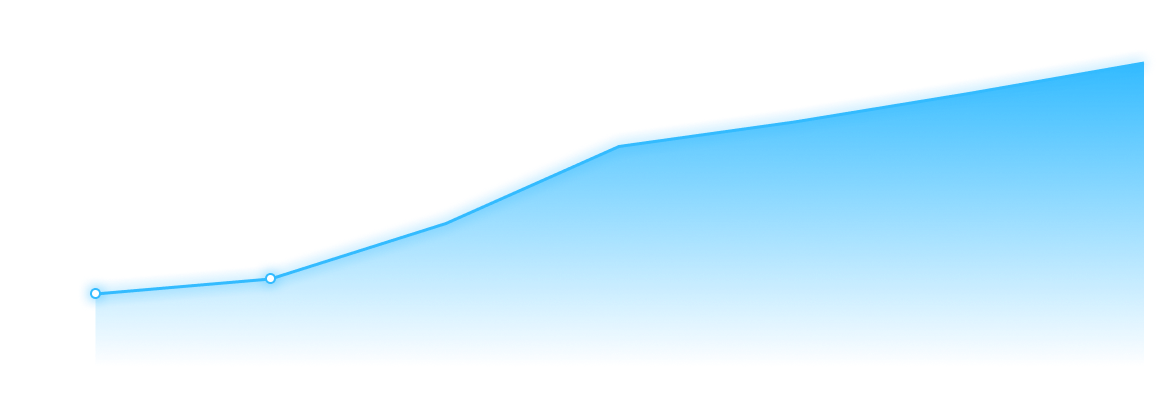

Historical US Dollar/Volume Sales of Whiskey

Leading Distiller Partnership

In 2020, Wilderness Trail was selected by the Kentucky Distillers’ Association to be featured as a landmark on the Kentucky Bourbon Trail.

Fund Advantages

Asset Backed

Access

*Investors gain access to a historically high performing asset class without administrative or operational hassle

Security

Liquidity

Fund Details

Portfolio

Structure

Up to $25mm or 25,000 barrels of new filled Kentucky Bourbon and Whiskey starting in 2020

Fees

5% upfront acquisition fee, 1% p.a. management fee, 15% performance fee on sold barrels

Investment Manager

Professional fund administration by experienced Prime Capital Core team

over 5 years

The value of Whiskey can appreciate significantly during it’s aging process, typically 3-5x over 5 years.

per annum

Fund level IRR Estimated to be over 20% per annum

over 5 years

The value of Whiskey can appreciate significantly during it’s aging process, typically 3-5x over 5 years.

maximum reduction in price

Whiskey is typically resilient in economic downturns; during the 2007-2009 crisis, YoY Whiskey sales by volume decreased only once by less than 1%

Media

Sign up for our research reports and Investor Letter

Other products and services

Index Fund

PrimeCapitalCore Select 5 Digital Fund provides exposure to one of the best performing asset classes of the last 5 years

Protocol Inventory Management

Tokenized staking fund for your protocol. Programmable liquidity through fully-compliant global exchanges We deal with all the administrative hurdles providing you the ease of use.

Income Fund

Wealth Management

Your ultimate solution for digital asset portfolio management, combining custody, execution, and tailored investment strategies.

Active VC Fund

NFT Fund

Advanced treasury solutions including managed liquidations, staking, and derivatives support - all provided by our 24/7 global trading team.